What is Drift Protocol?

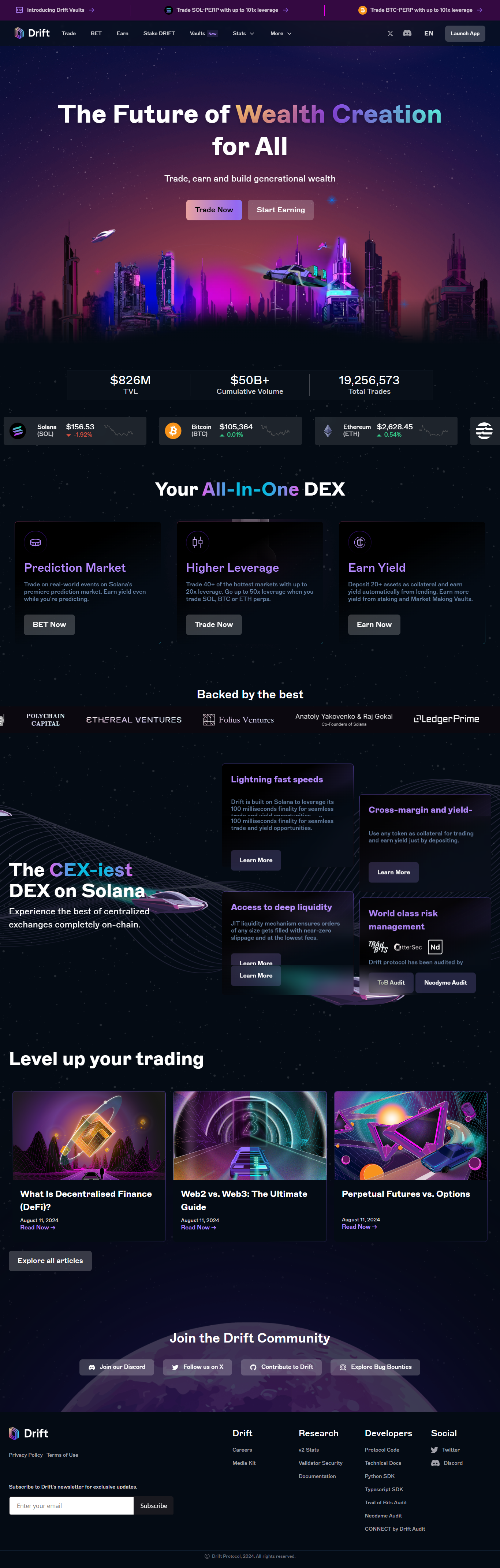

Drift Protocol is a powerful, decentralized perpetual futures exchange built on the Solana blockchain. As a non-custodial DEX, Drift enables users to trade leveraged positions with up to 10x leverage, while maintaining full control over their funds.

Unlike AMM-based DEXs, Drift DEX uses a dynamic virtual AMM (vAMM) combined with an advanced liquidity provisioning system. This architecture provides deep liquidity, efficient execution, and minimized slippage — making it ideal for derivatives traders seeking CEX-like performance on a decentralized platform.

Drift was designed to bring on-chain perps trading to the masses while leveraging the speed and low fees of Solana. Its intuitive interface and robust risk management tools make it appealing to both professional and retail traders in the DeFi ecosystem.

Key Features of Drift Protocol

1. Decentralized Perpetuals Trading

Drift allows traders to open long or short positions on supported assets using perpetual futures. With its permissionless and trustless model, users retain control of their assets without third-party risks.

2. vAMM + Liquidity Vaults

Instead of a traditional AMM or CLOB, Drift exchange utilizes a virtual AMM (vAMM) with dynamic pricing curves and liquidity provisioning. Liquidity providers earn yield while helping improve trading conditions.

3. Risk Engine v2

Drift features a cutting-edge on-chain risk engine, which handles real-time liquidations, collateral valuation, and account health. This ensures a secure and scalable trading environment.

4. Zero Gas Fees

Thanks to Solana's performance, Drift Protocol offers near-zero gas fees and sub-second transaction times — ideal for high-frequency derivatives trading.

5. Cross-Margin and Isolated Margin

Drift supports both cross-margining (using your full account balance to cover positions) and isolated margining (limiting risk to individual positions), catering to a wide range of risk profiles.

Drift Protocol Token (DRIFT)

The native utility token, DRIFT, plays several roles in the ecosystem:

- Governance: DRIFT holders can vote on protocol upgrades, risk parameters, and fee distribution models.

- Staking Rewards: Users can stake DRIFT to earn a share of trading fees and protocol incentives.

- Protocol Incentives: DRIFT is used to reward traders, liquidity providers, and active community participants.

As Drift scales and attracts more traders, the utility and demand for the Drift Protocol token is expected to grow significantly.

Drift Protocol Price Prediction

The price prediction for DRIFT depends on a variety of factors:

- Growth of Solana DeFi ecosystem

- Expansion of decentralized derivatives markets

- Protocol upgrades and partnerships

- Trading volume and platform adoption

Analysts believe that Drift is well-positioned to become a leading derivatives platform in DeFi. If adoption continues, DRIFT could outperform many mid-cap DeFi tokens in the long run.

Why Drift Stands Out

Compared to alternatives like dYdX, GMX, and Vertex Protocol, Drift DEX offers a unique mix of features:

- Faster speeds via Solana

- Innovative vAMM design

- Deep on-chain risk management

- Integrated LP vaults for passive income

This makes Drift ideal for serious traders who want decentralized leverage trading without sacrificing speed or security.

FAQ: Drift Protocol

1. What is Drift Protocol used for?

Drift is a decentralized exchange for perpetual futures trading on Solana, offering leveraged trading with deep liquidity and fast execution.

2. What makes Drift different from other DEXs?

Unlike AMMs or orderbook models, Drift uses a virtual AMM (vAMM) and on-chain risk engine to offer capital-efficient, secure trading.

3. Is there a Drift token?

Yes, DRIFT is the native token used for governance, staking, and incentives within the Drift ecosystem.

4. Can I earn passive income with Drift?

Yes, by providing liquidity to Drift vaults or staking DRIFT tokens, users can earn passive rewards.

5. Is Drift Protocol safe?

Drift is fully non-custodial and has undergone multiple smart contract audits. The risk engine provides real-time account monitoring and liquidation protection.

6. Where can I trade on Drift Protocol?

You can access the Drift DEX via its official site using a Solana-compatible wallet like Phantom or Solflare.

Made in Typedream